The primary objective of an e-commerce website is, of course, to sell.

To do this, once the order has been validated, you need to be able to collect payment from the customer.

There are a number of solutions for making online payments.

Online payment is a business in its own right, given the stakes involved in terms of security.

It is therefore common to use a trusted third party, such as a payment, financing or banking institution.

To make it even easier to set up online payment on a Prestashop site, there are specialized Prestashop payment modules.

Why use a payment module in Prestashop?

When you walk into a store, you can easily pay for your purchases by cash, cheque or bank card using a terminal.

When a potential customer places an order on an e-commerce site, they don’t have all these options at their disposal.

It’s impossible to send cash, and the use of a cheque considerably lengthens lead times, since payment has to be sent in addition to delivery.

Only online payment is really efficient.

The problem is that Internet users don’t have a payment terminal like those found in conventional stores.

This raises the question of how to set up a secure, easy-to-use payment system for the customer, whatever the platform used – computer, tablet or smartphone.

Various payment modules are available for Prestashop.

The aim is to provide a bridge between the customer and your business.

On the one hand, the customer must be able to transmit information securely, and on the other, the transaction must result in an actual payment to your company. The simplicity, security and efficiency of your payment module will be a real showcase for your Prestashop site.

If the procedure is too complicated or the security isn’t good enough, there’s a good chance that your visitors will never turn into customers.

According to the Baymard Institute, around 70% of transactions fail, abandoned by the visitor at the point of payment.

The main reasons, apart from the hidden costs charged by some sites, are a verification process that is too long or too complicated.

Potential customers, on the other hand, will remember a simple, secure procedure and return more easily.

Criteria for choosing a Prestashop payment module

There are many different payment modules available for Prestashop, but not all are created equal.

To help you select the one that’s right for you, we’ve listed a few criteria that need to be met.

Module installation, configuration and cost

The first thing to check is how easy it is to install and integrate the module into your Prestashop site.

If you have to spend several days getting the payment solution integrated into your site, this comes at a cost.

Check the quantity and quality of the documentation, the various reviews and make sure that effective support is available.

It doesn’t have to be dedicated support, but a dynamic community with lots of exchanges can help you make sense of things.

And don’t forget to check whether there’s a charge for using the module.

The publisher or supplier may offer installation fees, monthly fees or even per-transaction billing.

Easy module management

Just as the payment function needs to be simple for the customer, the management of the module needs to be simple for you.

You need to evaluate the functionality for managing transactions, payments and refunds, as well as the way in which all these operations can be reconciled with your accounting.

If you need to carry out multiple operations each time, you’d better move on to a simpler module.

Reliability and safety

Security is essential when managing this type of transaction.

A Prestashop payment module must support3D Secure authentication.

If it includes anti-fraud tools, even better.

Available options

It’s important to offer as many payment options as possible.

If the customer gets to the end of the order process and his usual or preferred means of payment is not listed, there’s every chance that he’ll abandon the transaction.

The usual means of payment must be present: credit cards, and possibly third-party payment methods such as Paypal.

If you wish to sell internationally, make sure that the module allows you to do so.

Payment options and preferences may vary from one country or region of the world to another.

The payment process should also be as simple as possible.

Customers shouldn’t have to wonder how many steps they’ll have to take before they can pay.

At a glance, they should understand what they have to do, and a few clicks should be all it takes to confirm payment.

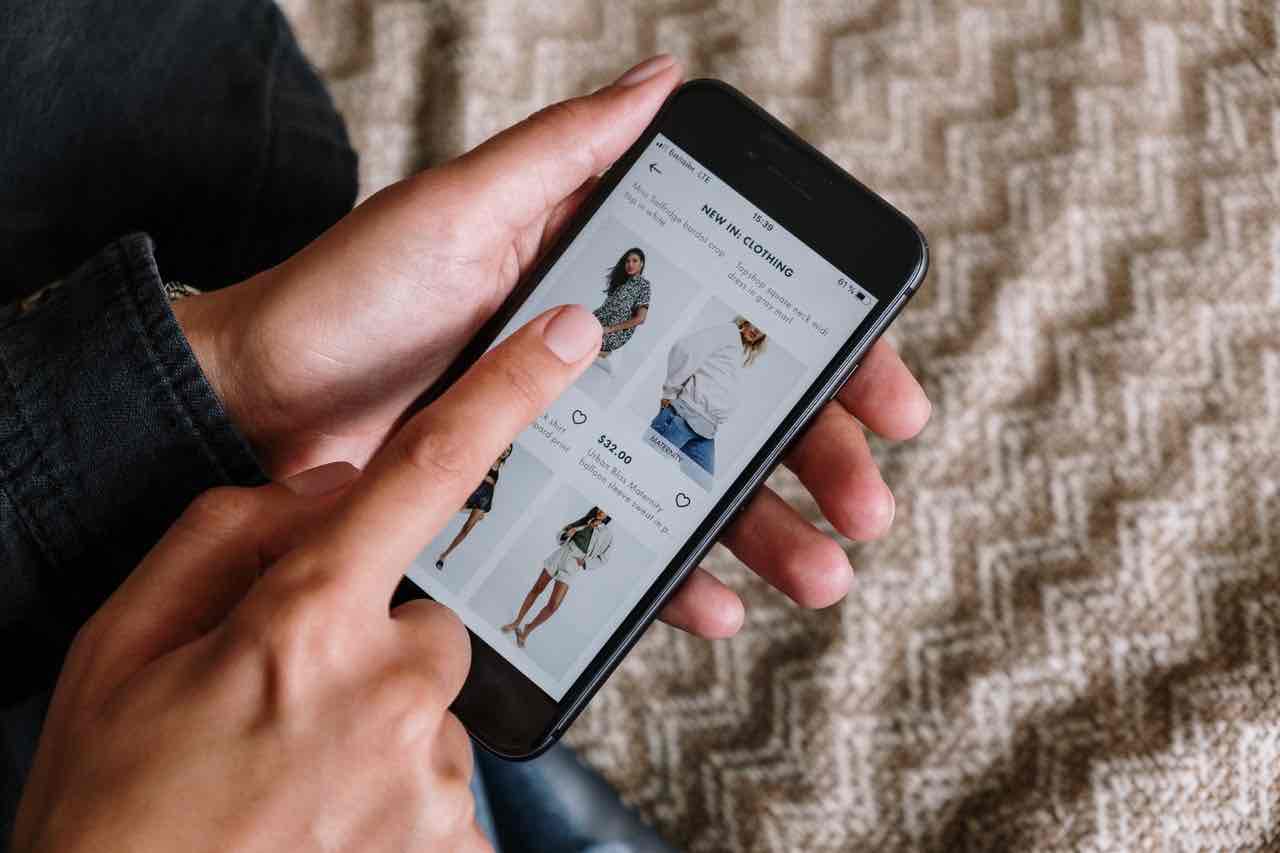

Mobile availability

Last but not least, the payment solution must naturally be able to be used from a mobile terminal.

Entering data on a smartphone or tablet is more demanding than on a computer with a keyboard.

So it’s particularly important that the transaction process is optimized for mobile devices, and that the customer needs to do as little as possible.

3 interesting features to integrate into your Prestashop payment module

Payment by phone

Also with a view to simplifying the process when the customer uses a smartphone, you can offer payment by phone.

This eliminates the need for the user to enter a credit card number.

A telephone number will be accessible for the payment, which will then be considered as a credit card transaction.

Payment by invoice

If you want to cater to a professional clientele, it may be worthwhile to offer an invoice payment option.

This allows your business customers to choose payment by invoice within 30 days, for example.

It is also possible to manage payment on account to secure transactions and protect against late payment.

Payment restrictions based on outstanding balance

There’s nothing worse than customers who are repeatedly late with their payments.

This can quickly become dangerous for your company’s cash flow.

To counter this problem, the “Monte à Bord Victor” module offers a payment restriction based on outstanding amounts.

If a customer is overdue or unpaid, payment options for any new orders can be restricted.

In this way, you don’t prevent this customer from ordering, but you do force them to pay by credit card this time, for example, to ensure that at least this last order is honored.

Once the customer’s other invoices have been paid and his outstanding balance has returned to normal, he can return to his usual payment options.

Experience at your service

With over ten years’ experience as a Prestashop developer, I can help you select, install and integrate the Prestashop payment module best suited to your needs.

Please don’t hesitate to contact me to discuss your Prestashop site.